Introduction: The Hidden Threat

You’ve found the perfect investment property. The price is right, the comps look good, and you’re ready to close. But what you don’t know could cost you tens of thousands of dollars after the deal is done.

Beyond the standard title search, hidden debts—known as municipal liens—can be attached to a property. These debts won’t show up on a typical title report but can become your responsibility the moment you take ownership.

This post will explain what municipal lien searches are, what they uncover, and why skipping this step is one of the most expensive mistakes an investor can make.

What is a Municipal Lien Search? (Beyond the Title Search)

A municipal lien search is an investigation into city, county, and local government records to uncover any outstanding debts tied to a property.

While a standard title search focuses on the chain of ownership and mortgages (voluntary liens), a municipal lien search uncovers involuntary liens—debts imposed by the government without the owner’s consent.

Think of it like this: if a title search is a background check on the owner, a municipal lien search is a full inspection of the property for hidden financial termites.

The "Expensive Mistakes": What a Municipal Lien Search Uncovers

Here’s where the hidden dangers lurk:

Code Enforcement Violations: Fines for overgrown grass, broken windows, unpermitted work, or unsafe structures. These fines can balloon into thousands of dollars.

Utility Liens: Outstanding water, sewer, or garbage bills. In many jurisdictions, these debts run with the property, not the owner.

Special Assessment Liens: Costs for neighbourhood improvements like sidewalks, street lights, or sewer lines billed to benefiting properties.

Unpaid Property Taxes: Usually caught in title searches, but discrepancies sometimes happen.

DEMOLITION (DEMO) Liens: If the city had to demolish a dangerous structure, the property owner becomes responsible for the cost.

Case Study:

An investor buys a $200,000 flip property. After closing, the city sends a bill for $25,000 in unpaid code enforcement fines and a special assessment for new sewer lines. Suddenly, the anticipated profit disappears. A municipal lien search could have flagged these issues beforehand, allowing the investor to negotiate or walk away.

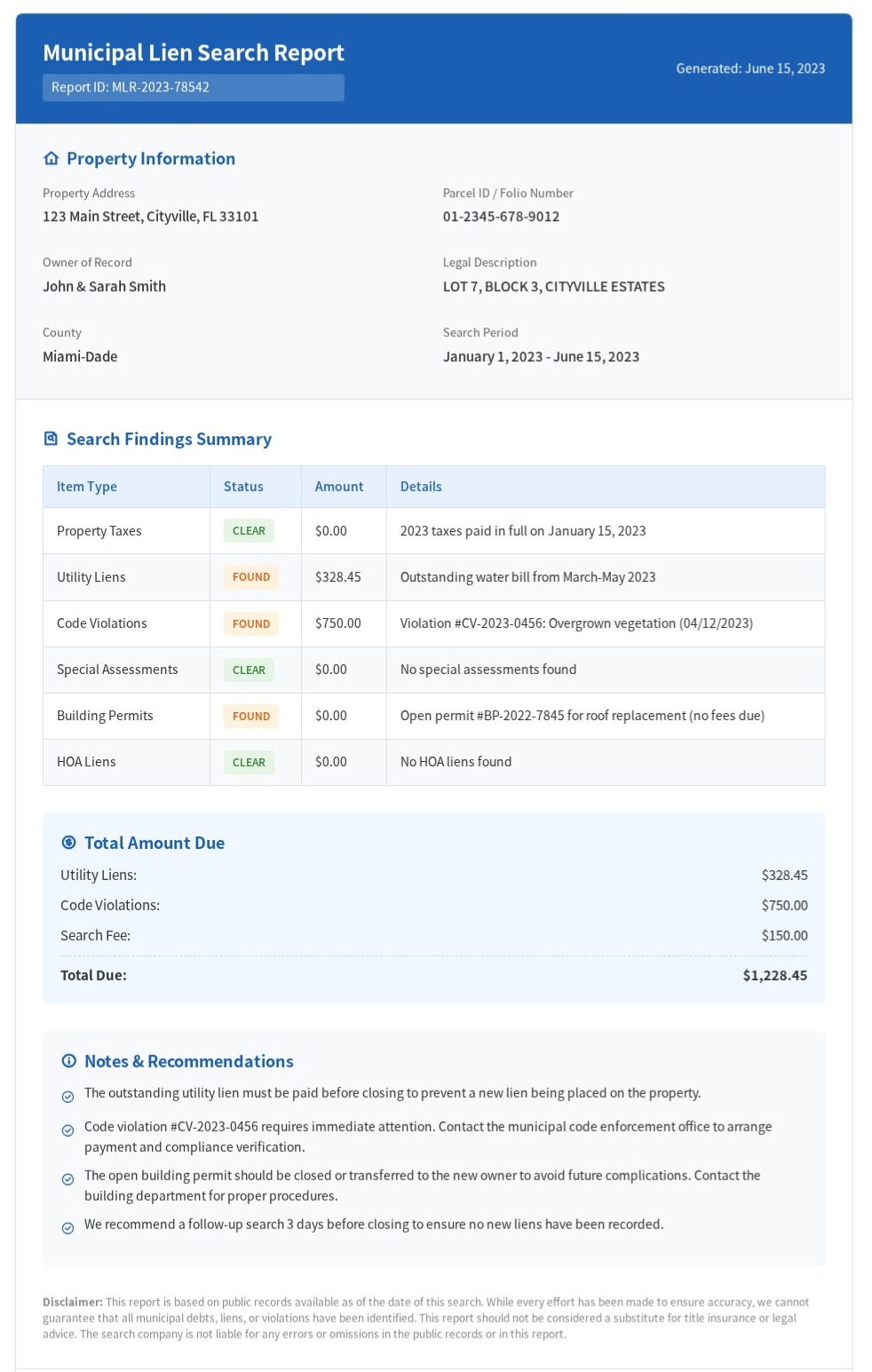

The samples are Below

How to Order a Municipal Lien Search (The Process)

Here’s the typical process:

Identify the correct municipality (city, county, or specific department).

Submit a request to each department (often in writing or via online portals).

Wait for the official report, which can take days or weeks.

For investors without the time or patience to contact multiple departments, third-party services specialize in compiling this information quickly and accurately—saving time, avoiding mistakes, and providing peace of mind.

Conclusion: An Insurance Policy for Your Investment

A municipal lien search is an affordable form of insurance. For an average cost of $200–$500, investors can protect themselves from catastrophic financial loss.

The question isn’t whether you can afford a municipal lien search. The question is whether you can afford not to.