Property taxes can be one of the largest yearly expenses for homeowners and real estate investors in Texas. But what if your property has been over-assessed? That means you’re paying more than you should. The good news: you have the right to file a property tax appeal or protest. In this guide, we’ll walk you through the process step by step so you understand when to file, how to prepare, and what mistakes to avoid.

1. What is a Property Tax Appeal?

A property tax appeal is a formal request to your local appraisal or assessor district asking them to review and correct your property’s assessed value. If the county has valued your home or commercial property too high, it directly impacts how much tax you owe. An appeal gives you the chance to show evidence—such as comparable sales or errors in your property record—that supports a lower and fairer valuation.

2. When Should You File an Appeal?

Timing matters. In Texas, most appraisal districts send out Notice of Appraised Value letters in April or May each year. You usually have until May 15th (or 30 days from the notice date, whichever is later) to file your appeal. Missing this deadline means you’ll generally have to wait until next year — although homeowners can submit a good cause letter explaining the delay. The county will review it and may process or reject your appeal, but ultimately it’s up to the county to decide on late submissions.

Key reasons to consider filing an appeal:

Your assessed value is higher than recent sales of similar homes in your area.

The appraisal district has incorrect property details (e.g., wrong square footage, extra garage, or a pool you don’t actually have).

Market conditions have shifted, but your value didn’t adjust accordingly.

You own investment property and rental income doesn’t justify the assessed value.

3. How to Prepare Your Evidence & Build Your Case

To have a strong property tax appeal, you need clear, organized evidence. The more precise and professional your documentation, the higher the chances of success.

Key items to gather:

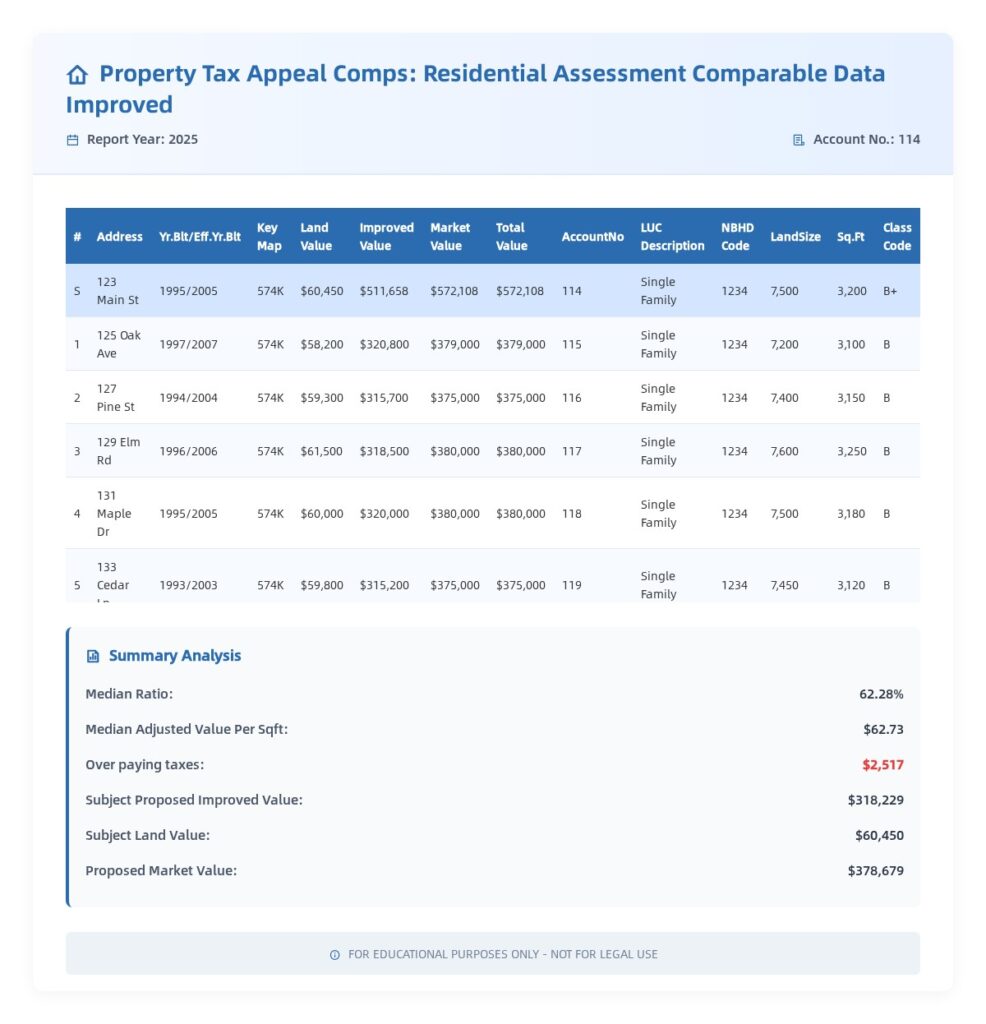

Recent Comparable Sales (Comps)

Look for similar properties in your neighborhood sold within the last 12 months.

Compare size, age, condition, and features etc..

Property Details Verification

Check your assessor’s record for square footage, number of rooms, garage spaces, and lot size.

Correct any inaccuracies — these can directly lower your assessed value.

Photographic Evidence

Take clear photos of your property to document condition, features, or any issues that may reduce value.

Permits and Improvements

Include records of any permitted renovations, or note if there are missing or unapproved structures that could affect valuation.

Exemption Documentation

Check for homestead, veteran, or senior exemptions. Ensure they are correctly applied.

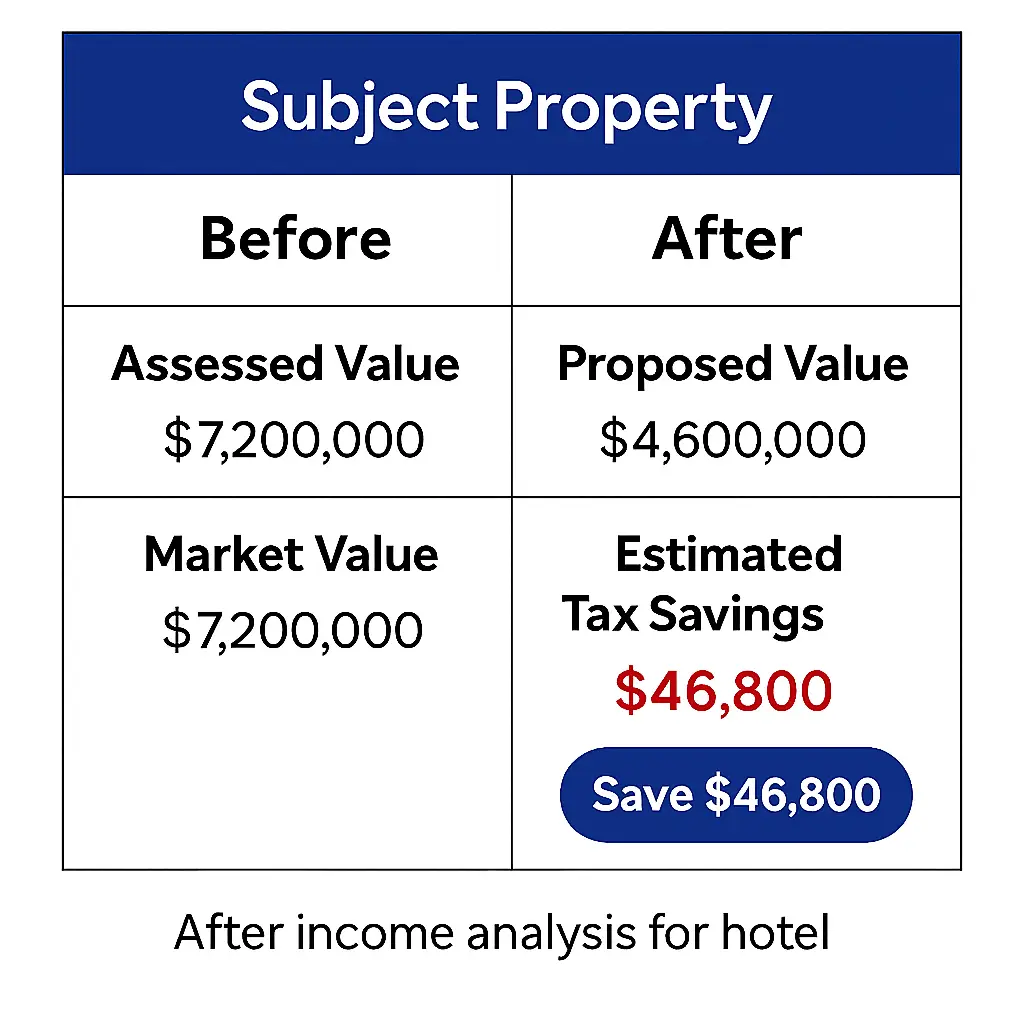

Professional Valuation or Expert Reports (Optional)

For commercial or complex properties, a certified appraisal or income analysis can significantly strengthen your appeal.

Tip: Keep all your evidence organized in a single PDF or folder, labeled clearly for submission. Counties review appeals faster when documents are easy to understand.

Clarification: We provide consultation and guidance, not legal representation. You submit the evidence and interact with the county as required.

4. Filing the Appeal & The Hearing Process

Once your evidence is ready, here’s what to do next:

Step 1 — Submit Your Appeal

Complete the county or city appeal form.

Attach your organized evidence packet.

Double-check deadlines — late submissions may be rejected unless a good cause letter is included.

Step 2 — Review by Appraisal District

The county appraiser reviews your evidence and may adjust your value immediately or schedule a hearing.

If more information is needed, they will contact you.

Step 3 — Hearing (if scheduled)

You can attend in person or provide written arguments.

Present your case clearly: highlight comps, errors, and exemptions.

The Appraisal Review Board (ARB) will ask questions and may propose a settlement.

Note: For online appeals, initial hearings can often happen via phone. The county usually gives an initial offer before moving to a formal in-person hearing if needed.

Step 4 — Decision & Updated Tax Bill

After the hearing, the ARB issues a decision and sends a county confirmation letter.

If successful, your assessed value is reduced, and your new tax bill reflects the savings.

If denied, you can usually appeal to district court or pursue litigation, but this is less common for residential properties.

Tip: Keep all correspondence and receipts — you may need them for future appeals.

Clarification: We do not represent your property legally at hearings; our role is consultation and guidance.

5. Common Mistakes & Why Work With Experts

Filing a property tax appeal may seem straightforward, but homeowners often make mistakes that reduce their chances of success:

Missing deadlines — even one day can disqualify your appeal.

Incomplete evidence — weak or disorganized documentation can result in denial.

Ignoring exemptions — many homeowners miss out on veteran, homestead, or senior exemptions.

DIY filings without guidance — navigating forms and county rules can be tricky, especially for complex properties.

Why Work With AnarchiSys

At AnarchiSys, we specialize in property tax appeals for Texas homeowners and investors. Here’s what we provide:

Deep research: we review assessor records, permits, and comparable sales.

Clear, copy-ready evidence packages: organized PDFs and Excel summaries for county submission.

Consultation & guidance: we help you understand your appeal, prepare evidence, and guide you through filing.

Time and stress savings: you focus on your property while we handle the technical work.

Note: We do not represent your property legally at hearings. Our services are strictly consultation, evidence preparation, and guidance.